- +1 929 367 8888(同台) / +1 929 356 6666(集團)

- info@multinationalholding.com

Hong Kong Releases the Policy Declaration on the Development of Hong Kong's Virtual Assets

The Hong Kong Financial Secretary issued the Policy Declaration on the Development of Virtual Assets in Hong Kong to clarify the regulatory attitude towards virtual assets. It is determined that virtual assets are indispensable, and the Hong Kong government strives to become a global virtual asset center.

On the 31st, the Hong Kong SAR Government issued a policy declaration on the development of virtual assets in Hong Kong, clarifying the policy stance and guidelines of the SAR Government on the development of a dynamic virtual asset industry and ecosystem in Hong Kong. The declaration said that Hong Kong is an international financial center, and the SAR government holds an open and inclusive attitude towards innovators engaged in virtual asset business around the world.

The declaration said that the SAR government is working with financial regulators to create a convenient environment to promote the sustainable and responsible development of Hong Kong's virtual asset industry. The SAR government will timely formulate rules to mitigate actual and potential risks in accordance with international standards, so that virtual asset innovation can flourish in a sustainable way in Hong Kong.

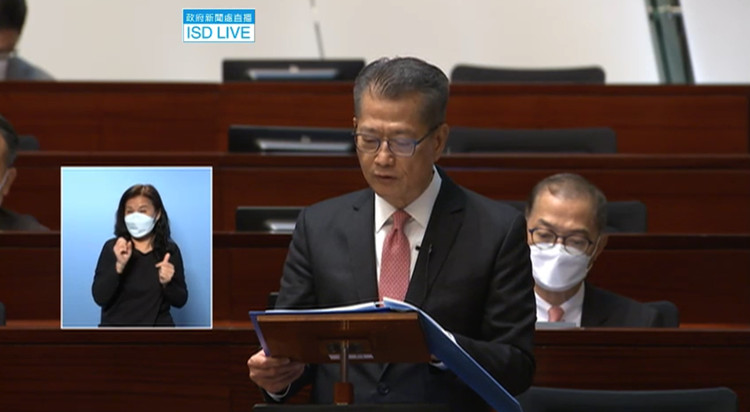

Chen Maobo, Financial Secretary of the Hong Kong SAR Government, delivered a video speech at the Hong Kong Financial Technology Week that opened on the same day, saying that the policy declaration mentioned the vision, supervision and test plan of the SAR Government on virtual assets, and the SAR Government looked forward to seizing the opportunities such as technological progress and financial innovation that virtual assets may bring.

"We hope to clarify our policy position to the global market and show our determination to explore financial innovation together with the global virtual asset community." He said.

Yu Weiwen, President of the Hong Kong Monetary Authority, said at the Hong Kong Financial Technology Week that the Hong Kong financial technology ecosystem is developing rapidly. Regulators need to be reasonably inclusive and innovative, but at the same time, they need to ensure financial stability and make consumers and investors understand the relevant risks.

Yi Gang, governor of the People's Bank of China, said when attending the Hong Kong Financial Technology Week via video that the People's Bank of China is cooperating with the Hong Kong Monetary Authority and other monetary authorities on the central bank's digital currency, hoping that such cooperation can better serve the needs of the international and domestic markets and help consolidate Hong Kong's position as an international financial center.

In addition, the declaration said that the SAR government and regulators are studying and launching three pilot plans, including the issuance of non homogenous tokens (NFT), green bond tokens and digital Hong Kong dollars at the Hong Kong Financial Technology Week, to test the technical benefits brought by virtual assets, and try to further apply relevant technologies to the financial market.

For this Declaration, Xu Zhengyu, Secretary for Financial Affairs and the Treasury of Hong Kong, said, "Hong Kong believes that distributed ledger technology (DLT) And Web 3.0 have the potential to become the future of finance and business, and these technologies are expected to improve efficiency and transparency under appropriate regulation. The government is ready to embrace the future. Hong Kong welcomes the convergence of financial technology and virtual capital industries and talents in Hong Kong. Hong Kong will strive to promote the sustainable development of financial services across the virtual asset value chain. "

Hong Kong is still the world's third largest financial center after New York and London, and the trading volume of various financial assets is far higher than Singapore. As one of the fastest growing regions in the world, Asia has a huge demand for digital assets from institutional investors and high net worth individual investors in the region. A large number of investors intend to participate in the digital asset market through Hong Kong financial institutions. We believe that Hong Kong and Singapore have their own advantages in the development of digital asset markets.

English ∨

English ∨

中文

中文